Underwriting platform

When businesses risk or lose money due to slow payment or non-payment from other businesses, insuring them from such risks is the task of credit insurance.

The aim was to redesign a digital solution for underwriters to help make decisions for insurance applications.

Contribution

Redesigned complex workflows for underwriters while working with them.

Adapted the design method for 2-week agile sprints and redesigned the design system.

Focus: Complex workflows, design for expert user, design for speed.

Working with the expert user

Underwriters (UW) are people who assess and decide (approve or reject) on the insurance application. We were designing a platform for them to deal with credit insurance applications.

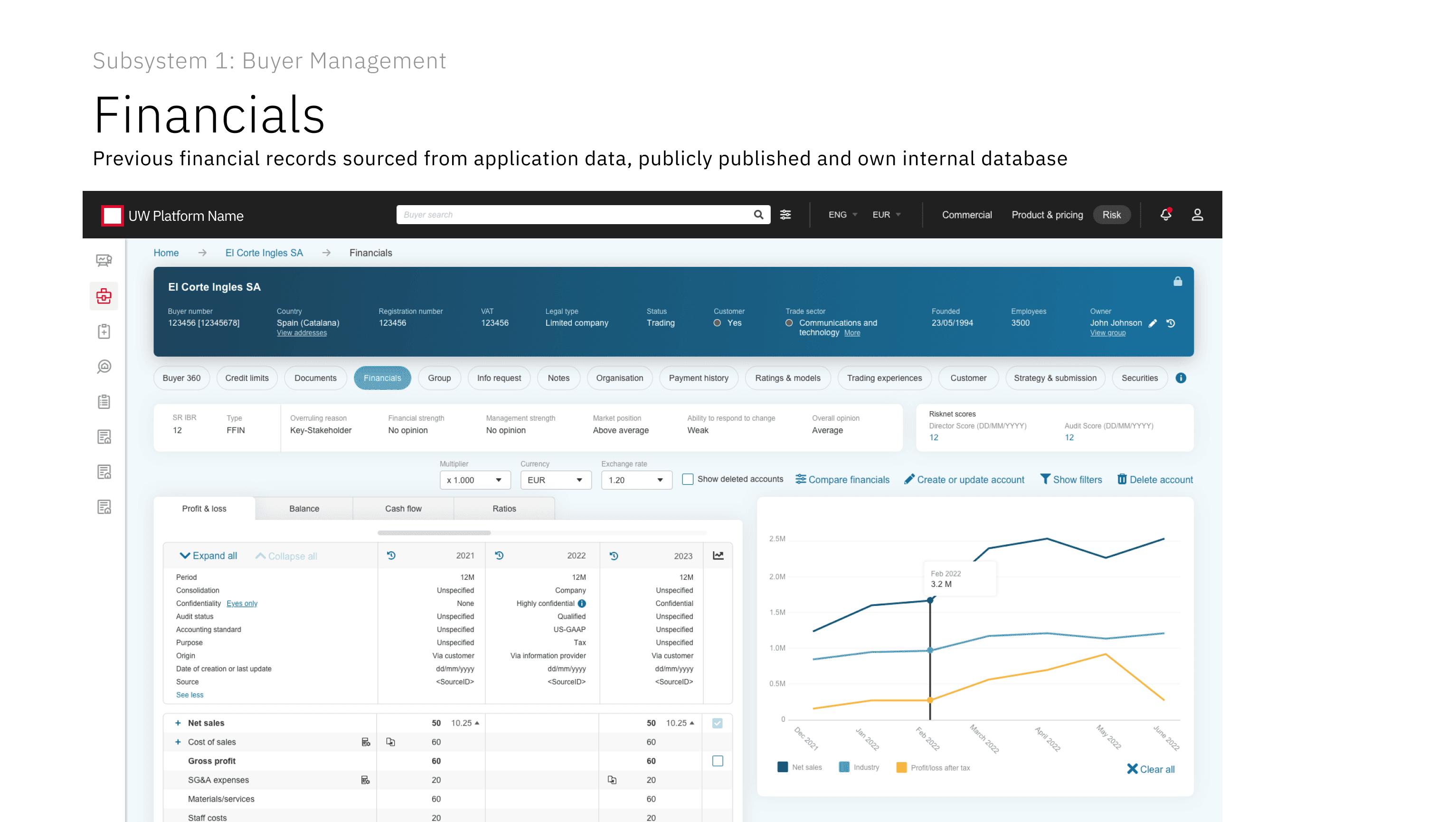

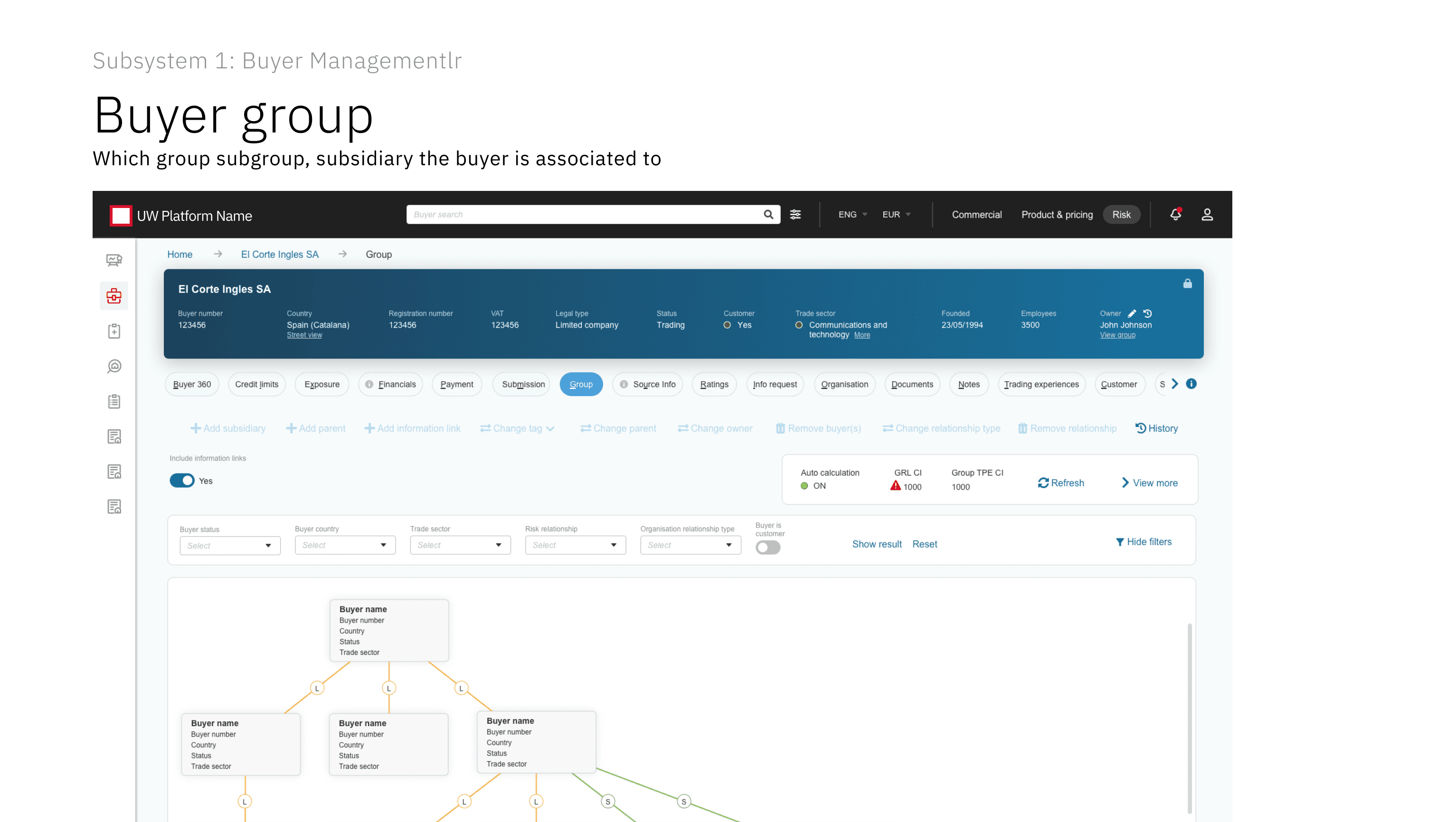

In credit insurance, customer is the company who applies for insurance (i.e. the insurance customer); buyer is the company from which the customer is at risk of non payment. The underwriter reviews the buyer and makes decisions.

In this project, some senior underwriters also worked with us as product owners in the project. Therefore, we were "building the product for the expert users with the expert users. This unique situation came with its challenges, insights, and opportunities to innovate.

Design process for this unique case

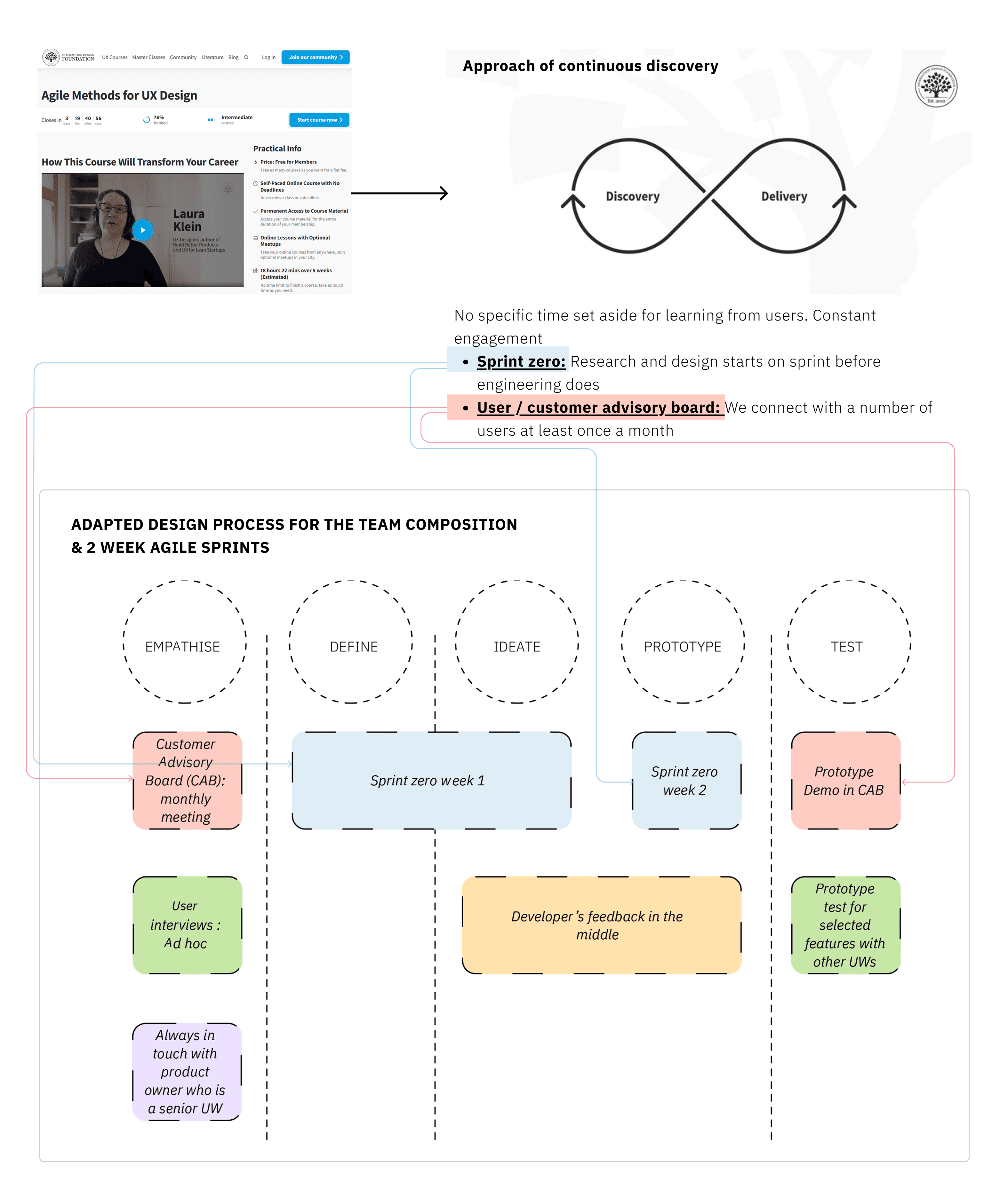

This unique case pushed us to rethink the design process setup for this project. When every feature is supposed to be designed in 2 week agile sprints (where there is no specific time set aside for user research and testing), we borrowed some concepts and the design and research approach of "Continuous Discovery" from the course Agile methods for UX design by IDF and tried applying it.

Project goals & New Underwriting workflow

The primary goal of the platform is to make manual underwriting cases as less as possible, whereas more efficient decision-making through speed and good UX.

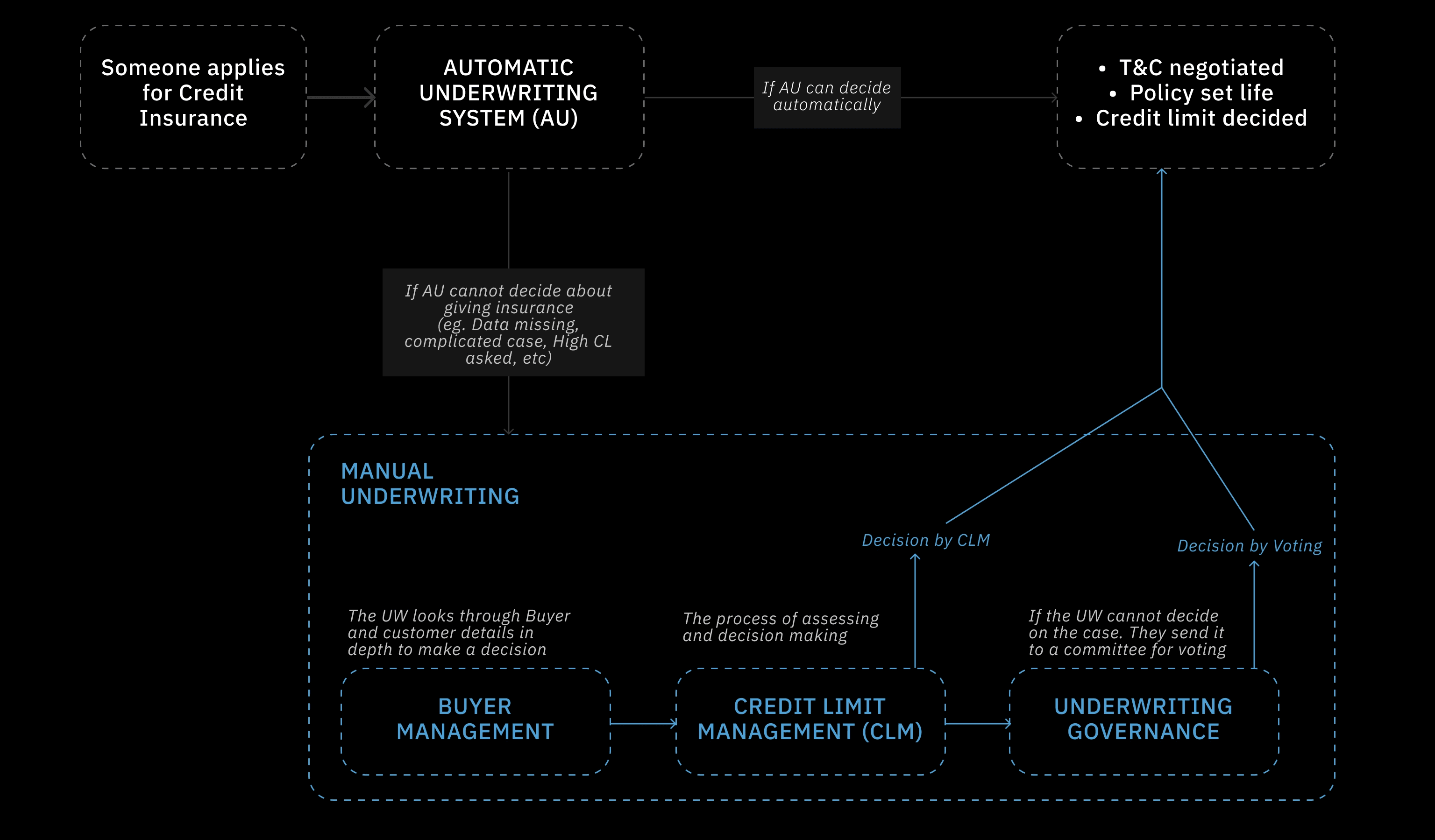

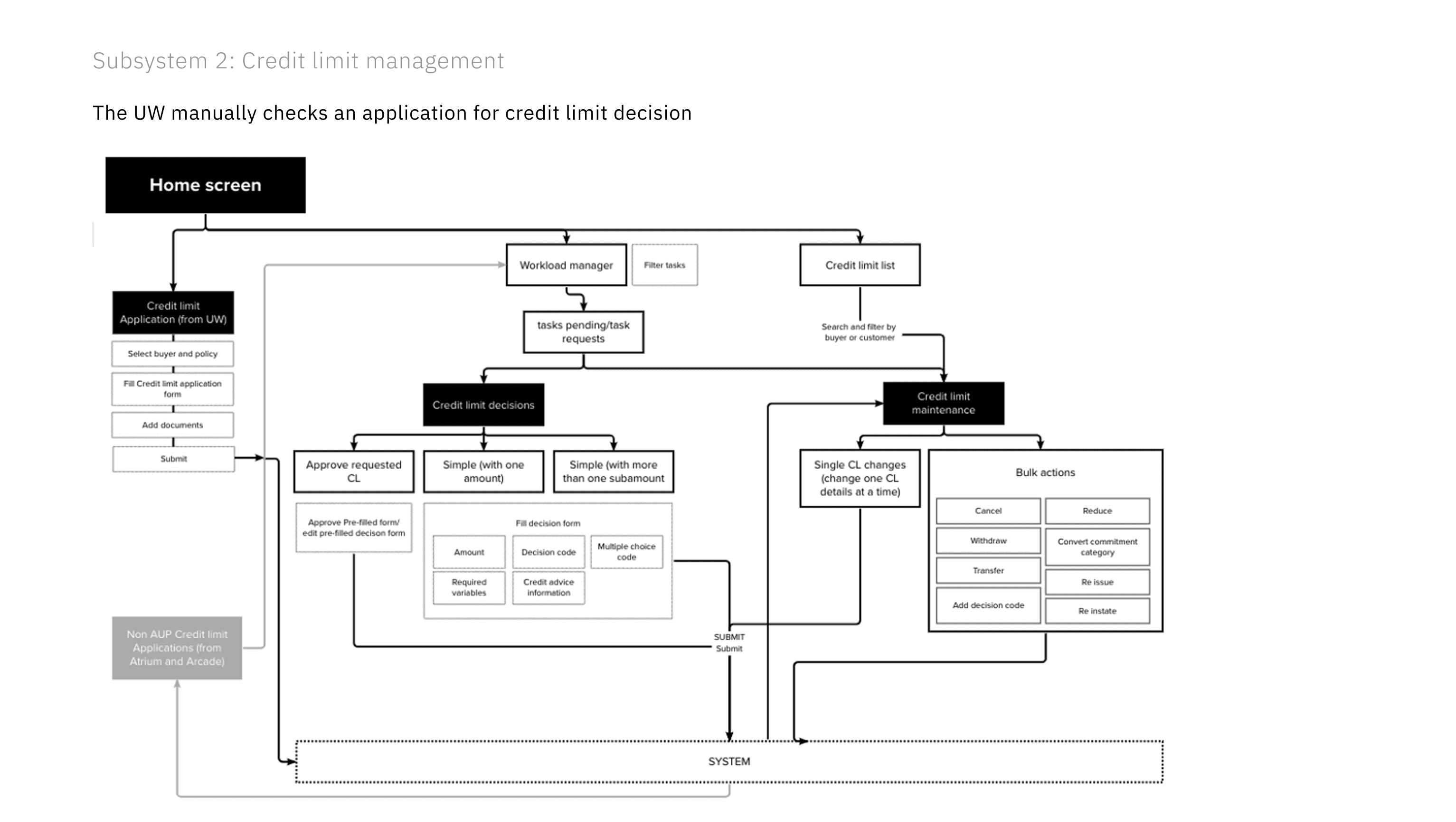

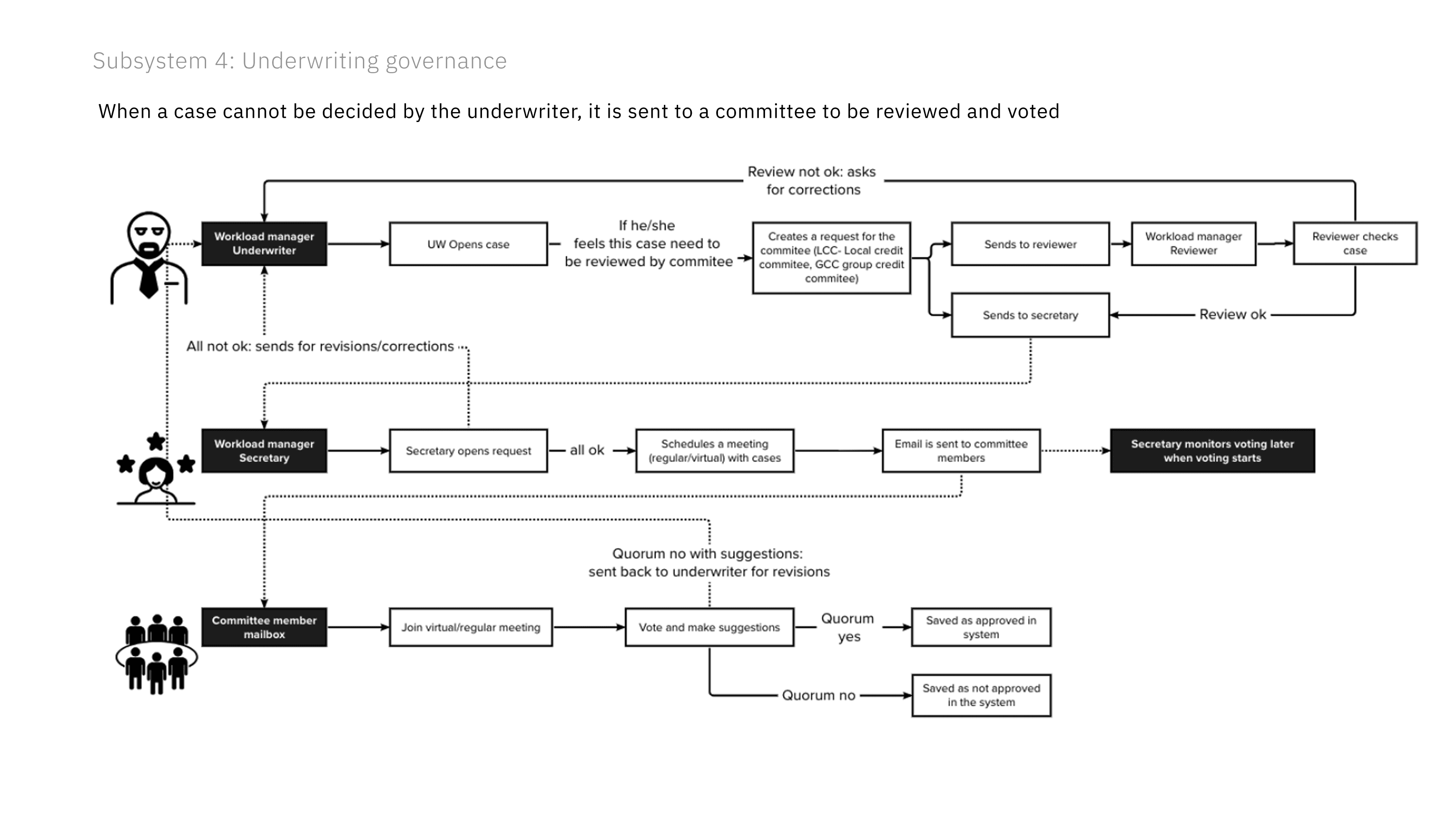

If the customer applies for credit insurance, an automatic underwriting system (an internal system, built with the help of underwriters) decides on the insurance application. In case of complicated cases, it sends them to underwriters who review manually going through buyer's financial records, credit history etc and decide. For even more complicated cases, they come together and vote. All of the manual underwriting and voting happens on the platform designed by us.

Key design contributions

New Design system

The previous platform was built long back and needed a look and feel update. Whereas there was already a client facing app and brand guidelines. The front end was built using Oracle Jet and we also had to incorporate Power BI for data heavy parts. We had to come up with a new design system which took account of all these while being unique and visually appealing.

Dynamic forms

Our earlier design had most data fields shown altogether, especially in forms. For every case, not all the data is relevant. All data fields at once without context overwhelms the user and leaving stuff empty gives an impression on incomplete form.

We introduced expandable sections which change based on pervious data.

People Bypassing Automatic Underwriting (AU)

One important business objective was to automate the underwriting process, which means running most applications through automatic underwriting system (AU). In insurance applications, many clients added notes (like "-", "__", "Please review", etc) to bypass the AU for underwriter's attention, adding underwriter's workload.

We realised that problem and in later designs, added dynamic forms with "notes" data-field under the "other" section, so that it's not misused.

Design for speed

Underwriters go through 100+ cases everyday therefore speed and efficiency becomes important. We achieved that though different methods; like UI elements to make pages skimmable, reducing clicks and designing for keyboard shortcuts.

Designing Multiple level navigation

Final UI and features

Each phase of the process is classified into subsystems and every subsystem as different features (slide to see more)

Some important features (slide to see more)

Key Takeaways

Working with the expert users and leading the design comes with its own challenges and learnings. In terms of managing and communication, these were some takeaways for me:

Understanding the big picture is most important.

Always over communicate to ensure everyone are on the same page

Make the expert user collaborators

*Currently the project is in final development (UAT ) stage. More updates to be continued…